Day 0: The Context & The Challenge

The Context:

I think that readers will be able to truly appreciate and empathize with where I’m at. It’s kind of embarrassing to admit this, but have to admit that four months after leaving my full-time job to pursue consulting – and my offerings through Mezclada! – I’ve burned through 80% of my savings. Most of this has just been to cover my fixed expenses.

I can’t tell you how many times I’ve cried in the last couple of months realizing that I’m still not reaching my full potential and my goals of earning 10K a month. I have felt like I’ve let myself down, like I’ve let my team down, and like I’m letting my family down.

It’s quite debilitating when your days are packed full with activities and the returns in income just aren’t there. And unfortunately it took me too long to speak up and finally start sharing with others that I needed help.

I also realized that there’s probably a bigger reason why I was put into this position, which is connected to the community that I hope to build through my work with Mezclada, and that’s to inspire and empower future farmers.

One of the things that I’ve been most intrigued about recently is this idea of marrying joy with financial abundance. And I believe that’s what many future farmers need in order to step into making their dreams a reality.

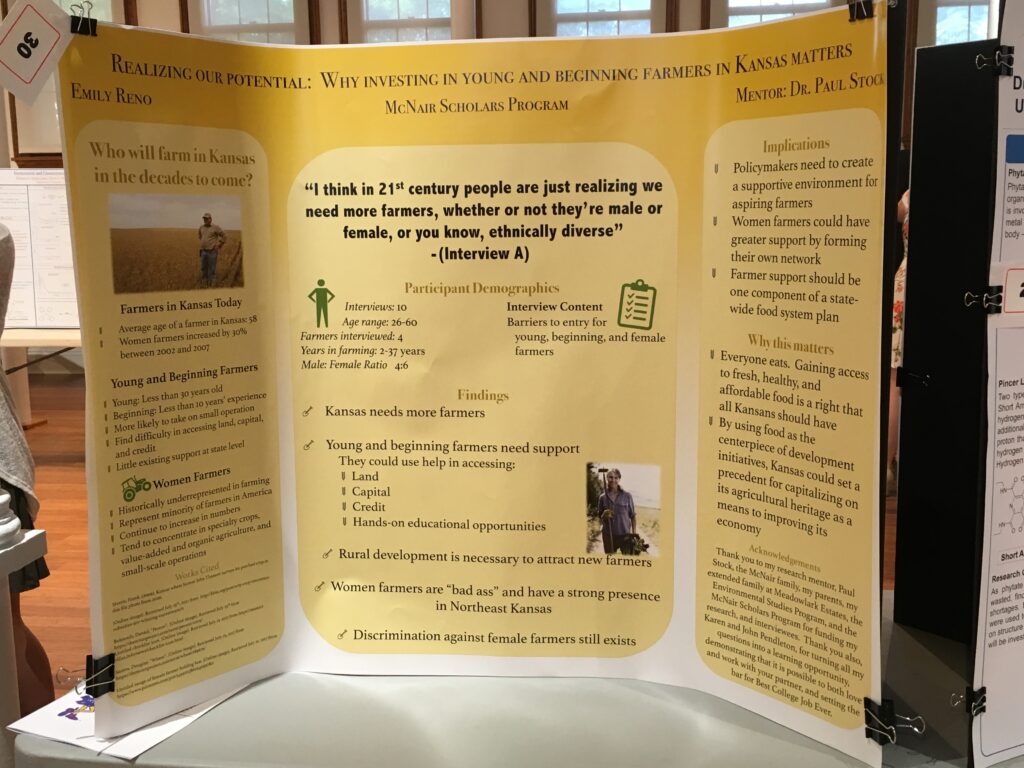

According to a national survey from the National Young Farmers Coalition, the biggest barriers preventing people from going into farming are accessing land and capital. I know this issue intimately, as it’s what I’ve studied since 2017, back when I was studying the barriers to entry for young and beginning farmers in Kansas.

In all of my dabblings in the field of personal growth and development, I think that there’s more to it than just having the practical knowledge. I think that mindset has a lot more to do with our success than people give it credit, and that having a strong source of social support is also absolutely essential. There’s empirical evidence that shows that social support is also a indicator for people’s mental health.

Basically what I’m saying is that I’ve reached my breaking point. And I am taking matters into my own hands. I’m not going to pretend like someone else is going to dig me out of the whole that I’ve put myself in. And I’m going to invite you to join me.

Why? Because in order to get yourself in the position to purchase farmland, you’re going to have to do a lot more than understand how to create a P&L statement or write a check. And in order to develop financial sustainability for myself so that I can start saving towards farmland, I’m going to need to get my shit together.

The 60-day financial fitness challenge

I’m a fan of 30-day challenges. I’ve done more than I can probably count on my hands, whether related to mindfulness, yoga, push-ups, gratitude, and more. And I’m personally not comfortable with earning less than my fixed expenses for more than two more months. Because that means dipping into my last reserves of my savings, which I’ve been putting towards longer-term investments (like a new car, an international yoga teacher training), and I’m not about to do that. I also think it’s just really stressful living like this and I know that I’m capable of figuring this out.

I like the term financial fitness because of the connotation that it carries. Fitness in general is a practice. It’s not something that happens overnight, and it’s something that must have different systems and checks and balances put in place to ensure that you stay on track with your goals. A lot of themes around fitness have to do with removing barriers that make exercise hard, creating accountability buddies/systems for yourself, designing rewards for yourself, and measuring progress along the way.

Similarly, I believe that in creating a financial fitness challenge for myself that’s also tailored to my community – I know many of you out there also want to buy farm property – I can take these elements and put them into practice in my own way. And you can join in on the fun, too! Even if you don’t start on day 1 with me. Share your successes, challenges, progress, and more. I want to hear it. And I’ll keep cheering you on.

The deets:

- 60 days of consistent activity towards reaching my financial goals by 1) Getting my finances organized, 2) Reducing my expenses, 3) Increasing my income/earning capacity, 4) Working on my mindset, 5) Educating myself, 6) Building community and accountability for my goals, 7) Measuring my progress, 8) Posting to my blog consistently with updates, and 9) Anything else that strikes my fancy along the way

The ground rules:

- Complete 1 item on the list each day. They don’t have to be completed in chronological order. Some items will likely require sub-steps, so these can be added and counted as 1 new item.

- Post to the blog every day of the challenge. The only exception is if I am sick.

- Share the numbers, down to the last penny. If I’m not being real with myself about my finances, how do I expect myself to be honest in other areas of my life? This may be on a weekly basis.

- Maintain positivity, gratitude, and generosity. Lean into the vibration of love, always.

- Leverage my resources. Don’t hesitate to ask for help.

- Start with a list of at least 20 items from which I can start tackling, one each day, and add to the list as I go.

Some factors that are likely to make this somewhat challenging:

- I’m traveling abroad for two months in January and February and working remotely. I still haven’t exactly narrowed down my lodging situation yet. But I’m getting there. And thinking very critically about how to make this budget-friendly.

- Holidays. Christmas is still a thing. And while I’ve been doing Christmas shopping all year long, people always still have a list for me.

Here’s the low-down on where I’m starting as of Day 0:

Checking: $676

Savings: $1903

Emergency Savings: $3700

Investments: $17K

Where I was in June – A bit over 10K in ‘accessible’ savings and about 3K in ‘emergency emergency’ savings.

Where I’m at right now: Not where I was.

Where I’d like to be in 60 days:

- 3K a month minimum (see below for more details about the digital nomad visa I’m applying for), but shooting for the stars at 7500 a month

- Mentally abundant/wealthy

Where I’d like to be long-term:

- 100% of fixed expenses covered by passive income

- Living in Costa Rica! Having spend the past two years traveling to Costa Rica during the winter months, I have fallen in love with both the country and its people and very much see myself there long-term. I’m working towards applying for the digital nomad visa, which would allow me to work remotely for up to 2 years. I think this is a very good move in the right direction, surely opening up doors to opportunities that I could never even have imagined.

Another set of goals that I’ve been putting into place since meeting with a financial advisor and having hired a financial coach for the first six months of 2022 are as follows:

- Max out my HSA (7K) as soon as possible

- Get my ‘flexible savings’ back up to 10K

- Start contributing again to my retirement savings (was putting away $800/mo. With my other job)

- Continue to automate and increase my contributions to my other savings goals

- Yoga teacher training

- New car

- 60th b-day gift for my mom

- International travel

- Farm property or a house?!

The list:

Now that we’ve got the ground rules and goals out of the way, let’s talk about taking action. What is this going to look like for me? Very personalized, but also very universal. Some of these are likely to be incredibly specific to my situation, but I have a feeling many of you out there will find some nugget you can latch on to in what I’ve listed here. Make it your own. Come up with your own list. I made a commitment to myself to start with 20 and then add from there. It’s likely that some of the bigger goals will require some smaller goals, which I’ll add as a single day’s task, and shift things around as needed.

This list was originally drafted and published the same date of the article. I’ve put an asterisk by the number that marks the last of the one that I’m ending with for now, and add to it as I go. I may add here or in future posts. The mechanics of that are to be determined.

Without further ado….

- Pay off all credit card debt

- Cancel any credit cards I’m not using

- Set up a meeting with Meritrust Credit Union to leverage my savings for high interest

- Meet with my accountant to go over taxes for my business and opportunities for saving

- Book a 1:1 with my financial coach

- Eliminate any unnecessary recurring expenses

- Mark off on calendar cancellation dates for unnecessary expenses

- Tailor content I consume to focus on money mindset, financial literacy, and entrepreneurship/increasing earnings (podcasts, YouTube videos)

- Pursue 5 contract leads

- Create an account on Creative Market

- Subtask: Develop a digital portfolio via Behance on Adobe

- Develop a digital asset to sell via Envato Market, Creative Market, Adobe stock, or others

- Host a workshop/webinar on healing your relationship with $

- Clean up my weekly budget spreadsheet to account for annual tech expenses

- Donate to a non-profit I care about

- Host a workshop/5-day challenge/publish resource guide on digital marketing for farmers

- Create a resource on production position/high-value market channels

- Publish a resource on leveraging your human design chart as part of business strategy

- Publish a resource on copywriting/storytelling as it relates to farming

- Write a positive review for a podcast I love

- Complete the TBM workshop about $

- Write a hand-written thank you card to someone who has supported me financially in the past

- Practice visualizing the wealthy version of myself during my daily meditation practice and observe the characteristics of that person. Journal about what I would need to change in order to become that person.

- Conduct an informational interview/podcast interview with someone who I admire for their financial literacy/success

- Cook a meal and share it with someone else

- Do something that one of my newsletter subscribers or social media followers suggest

- Sign up for gas rewards

- Write an article for an existing publication

Tomorrow starts day 1! Wish me luck.